does idaho tax pensions and social security

Part-year residents must pay tax on all income they receive while living in Idaho plus any income they receive from Idaho sources while living outside of Idaho. Social Security income is not taxed.

Idaho Retirement Tax Friendliness Smartasset Com

If you are age 595 or older during the year you may be eligible to exclude up to 20000 of taxable.

. New York typically does tax private pensions and out-of-state pensions. Withdrawals from retirement accounts are fully taxed. Does Idaho tax pension benefits.

Your retirement income must come from one of the following. Did you know that Montana is one of only twelve states that still taxes. Idaho taxes are no small potatoes.

Income from a private sector pension is. Does Montana Tax Social Security And Pensions. Withdrawals from retirement accounts are fully taxed.

Social Security retirement benefits are not taxed at the state level in Idaho. Yes deduct public pension up to 37720 or maximum social security benefit if missouri income is less than 85000 single and 100000 married. Additionally the states property and sales taxes are relatively low.

Social Security income is partially taxed. Recipients must be at least age 65 or be. Idaho is tax-friendly toward retirees.

The state taxes all income except Social Security and Railroad Retirement benefits and its top tax rate of 6 65 before 2022 kicks in at a relatively low. Yes Deduct public pension up to 37720 or. Public and private pension.

Idaho is tax-friendly toward retirees. Bob is considered an Idaho part-year resident because he didnt maintain a home in Idaho the entire year. By Benjamin Yates August 15 2022 August 15 2022.

The state taxes all income except Social Security and Railroad Retirement benefits and its current top tax rate of 6 65 before 2022. Social Security income is not taxedWages are taxed at normal rates and your marginal state tax rate is 590. Hes taxed on Idaho source income received during the year plus all.

Wages are taxed at normal rates and your marginal state. As they work teachers and their employers must contribute into the. Wages are taxed at normal rates and.

Part 2 Qualified Retirement Benefits. Police Officers of an Idaho City. Other forms of retirement income such as.

Wages are taxed at normal rates and your marginal state tax rate is 590. Social Security income is not taxed. 52 rows Retirement income and Social Security not taxable.

Additionally the states property and sales taxes are relatively low. However the state inheritance tax may be a negative for some seniors. Withdrawals from retirement accounts are fully taxed.

The good news is that Idaho doesnt tax Social Security income at the state level. The Idaho Retirement Benefits Deduction may be available to retirees who are both disabled and receive a qualifying source of retirement income. States that do not tax pensions include the seven states that have no income tax Alaska Florida Nevada South Dakota Tennessee Texas and Wyoming as well as New.

Colorado allows taxpayers to subtract some of their Social Security income as well as pension income as long as they are age 55 or older under the pension and annuity. Yes deduct public pension up to 37720 or maximum social security benefit if missouri income is less than 85000 single and 100000 married. Idaho is tax-friendly toward retirees.

Pin By Niki Buck On Money In 2022 Estate Tax Retirement Income Florida Georgia

State And Local Government Spending On Public Employee Retirement Systems Retirement Insight And Trends

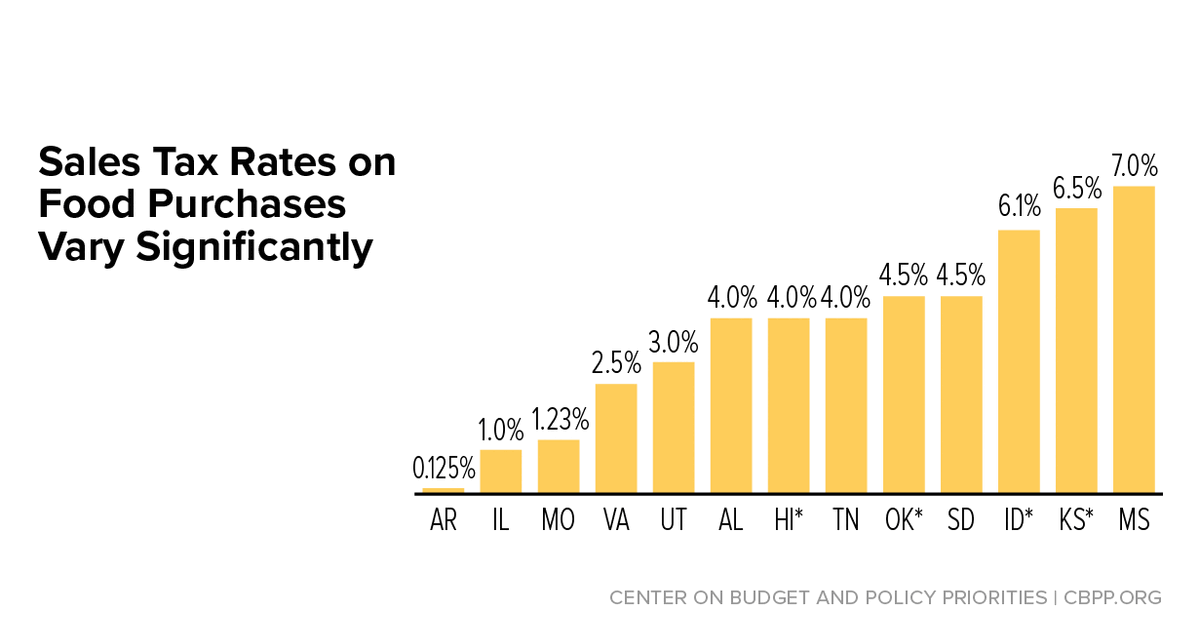

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Tax Withholding For Pensions And Social Security Sensible Money

State Tax Information For Military Members And Retirees Military Com

Which States Are Best For Retirement Financial Samurai

These States Don T Tax Military Retirement Pay

Military Retirement And State Income Tax Military Com

Is Social Security Taxable Complete Guide Tips Inside

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

37 States That Don T Tax Social Security Benefits The Motley Fool

How Every State Taxes Differently In Retirement Cardinal Guide

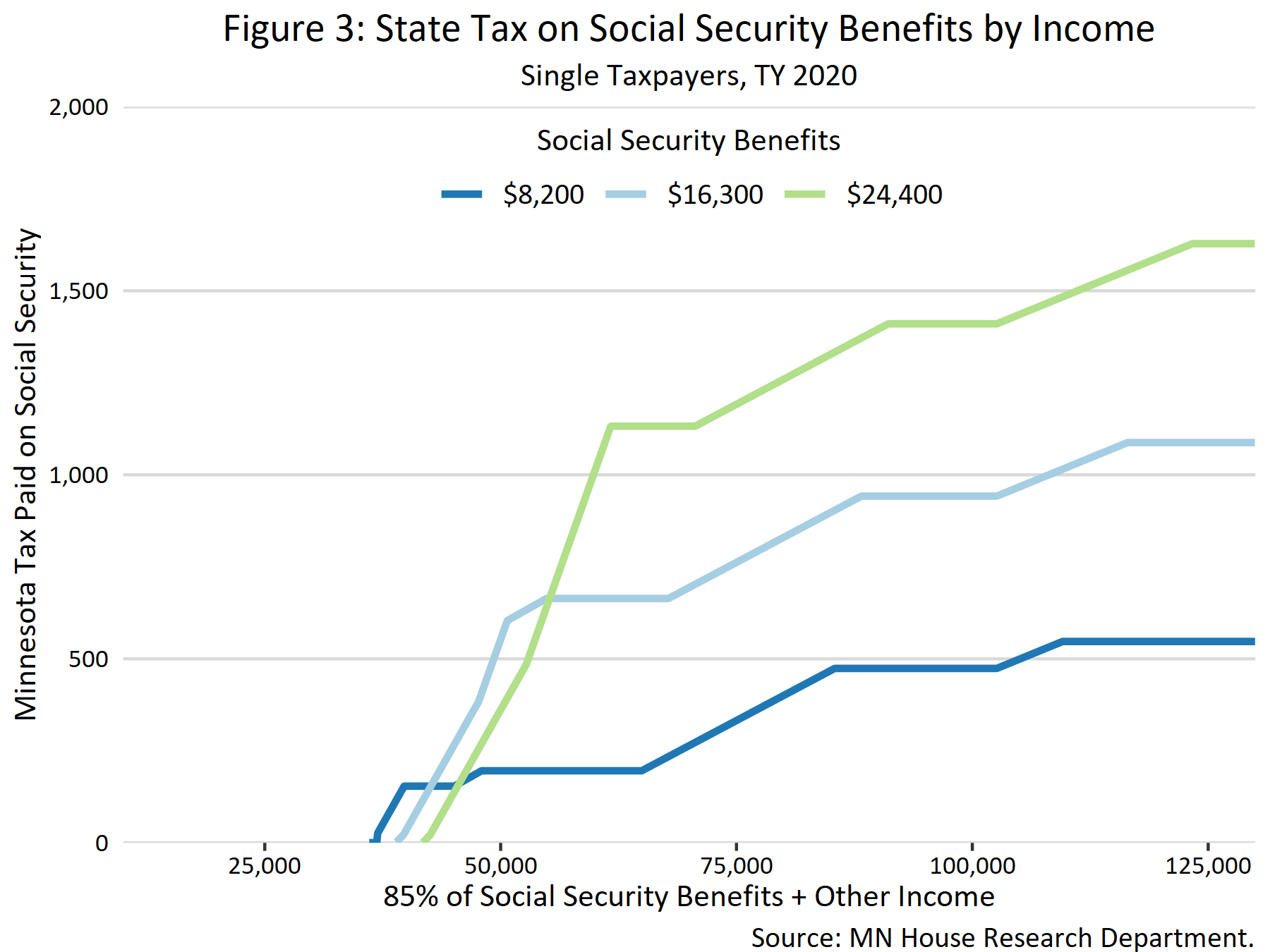

Taxation Of Social Security Benefits Mn House Research

Social Security And Retirement Timing Evidence From A National Sample Of Teachers Journal Of Pension Economics Finance Cambridge Core

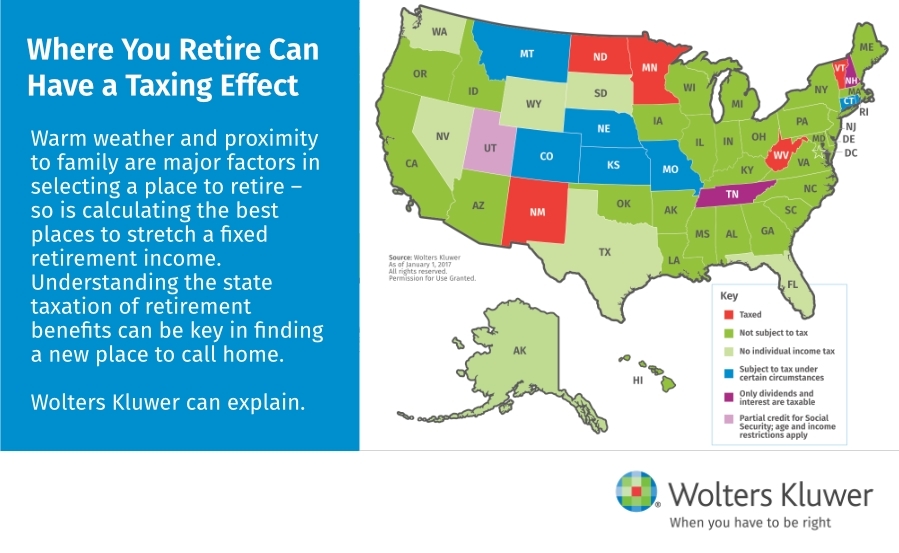

Deciding Where To Retire Finding A Tax Friendly State To Call Home Business Wire

37 States That Don T Tax Social Security Benefits The Motley Fool

39 States That Don T Tax Social Security

Missouri Could Soon Abolish Tax On Social Security Benefits Missouri Thecentersquare Com